Cross-Border Care: How Doctors Reduce Payment Friction for International Patients

Updated January 2026

Quick Answer

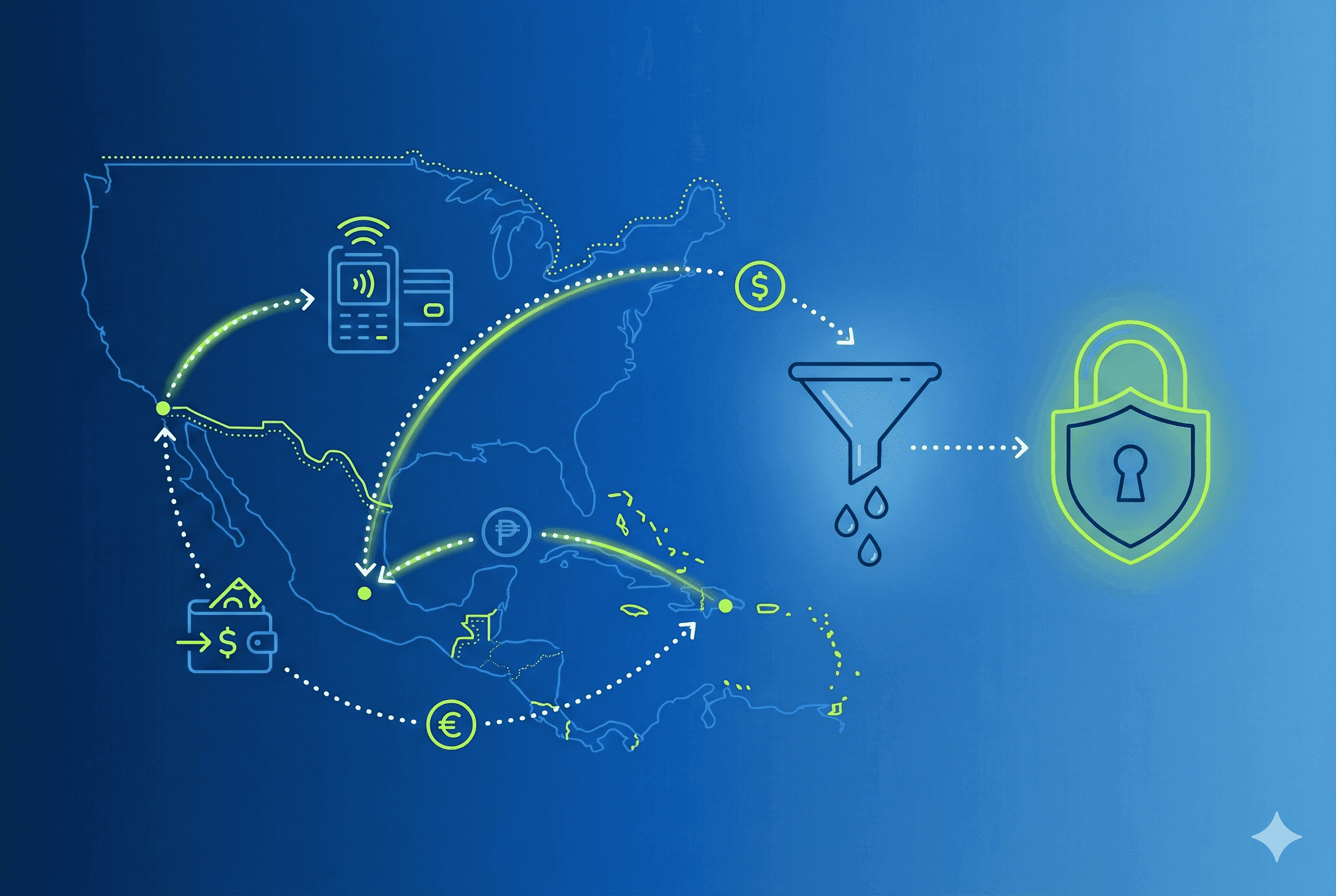

Cross-border healthcare payments are a major source of patient drop-off in international care. Providers that reduce payment friction—through digital checkout, documented transactions, financing access, and integrated coordination—convert more existing demand into completed care while improving safety, trust, and operational efficiency.

Why is there so much friction in paying for cross-border care?

International patients rarely abandon care because of clinical uncertainty alone. More often, they disengage when logistics feel risky, slow, or unclear—especially around payments.

Healthcare systems were designed for domestic reimbursement, not for patients paying across borders, currencies, and regulatory environments. As a result, many providers still rely on:

- cash or informal transfers

- manual confirmation via messaging apps

- delayed invoicing

- fragmented documentation

The World Health Organization has repeatedly emphasized that administrative and financial barriers are a structural determinant of healthcare access, particularly for patients navigating care outside their home system (according to the WHO Universal Health Coverage framework).

In cross-border care, payment friction becomes a care barrier, not just a billing inconvenience.

What is the “leaky bucket” problem in international patient care?

The “leaky bucket” describes a pattern providers see every day:

- inbound inquiries arrive consistently

- consultations are discussed

- treatment plans are shared

- then… patients disappear before booking or paying

This leakage usually occurs after clinical alignment but before financial commitment.

Research on patient access consistently shows that complex administrative steps sharply reduce completion rates, even when patients intend to proceed. Health-system access studies cited by the OECD show that out-of-pocket complexity and unclear payment processes directly correlate with care deferral or abandonment (see OECD Health at a Glance).

In cross-border contexts, the leak accelerates because patients are also managing:

- foreign banking rules

- fraud anxiety

- currency conversion

- time-zone delays

- language gaps

Why payment trust matters as much as clinical trust

Patients may trust a surgeon’s credentials, but still hesitate if payment feels unsafe.

From the patient perspective, common concerns include:

- “Will my payment be acknowledged?”

- “What happens if plans change?”

- “Who do I contact if something goes wrong?”

- “Will I have proof for insurance, financing, or disputes?”

The U.S. Federal Trade Commission notes that healthcare payments are among the highest-risk categories for consumer fraud anxiety when conducted digitally across borders (per the FTC Consumer Protection guidance).

For providers, unclear payment flows also create:

- reconciliation errors

- staff time spent confirming transfers

- delayed scheduling

- refund disputes

Reducing friction means making payment boring, predictable, and documented.

How are cross-border healthcare payments evolving in 2026?

Across international care hubs, providers are shifting from transactional payment handling to infrastructure-level payment coordination.

1. Digital payments are replacing cash-dominant workflows

Cash remains common in many destinations, but it introduces risk for international patients. Central banks and financial authorities—including Banco de México—have identified digital payments as a priority for transparency and inclusion (per Banco de México payment systems overview).

Healthcare providers adopting secure digital checkout see:

- faster deposits

- fewer no-shows

- clearer accounting

2. Documented transactions are now a safety expectation

Healthcare payment traceability aligns with global security standards such as those defined by the PCI Security Standards Council, which sets baseline requirements for protecting cardholder data (see PCI SSC).

For international patients, digital receipts and confirmations are not optional—they are a trust requirement.

3. Financing access is reshaping conversion timelines

Many international patients can afford care, but not all at once.

Regulatory bodies such as the Consumer Financial Protection Bureau have documented the rapid adoption of installment-based payment models in U.S. healthcare, particularly for elective and semi-elective procedures (per the CFPB BNPL analysis).

When financing is integrated into the care flow:

- patients commit earlier

- providers schedule sooner

- administrative follow-up decreases

How does payment friction affect safety and outcomes?

Payment delays are not neutral—they affect care timing.

The Journal of Travel Medicine has highlighted that fragmented pre-procedure coordination, including payment delays, increases the likelihood of rushed scheduling, missed pre-op preparation, and inadequate follow-up in cross-border care scenarios (see Journal of Travel Medicine).

From a safety standpoint, streamlined payment enables:

- predictable scheduling

- proper pre-op timelines

- coordinated post-care instructions

In other words, financial clarity supports clinical clarity.

What strategies actually reduce payment friction for international patients?

Providers that successfully retain international patients tend to implement the same core strategies:

- Centralize payment within the care workflow

- Support familiar payment methods

- Offer financing where legally and operationally appropriate

- Provide immediate confirmation and documentation

- Reduce staff mediation

Payments should not live “outside” the patient journey. When payment, scheduling, and documentation are connected, patients move forward with confidence.

International patients trust systems they already use. Supporting credit, debit, mobile wallets, and bank-based options reduces hesitation.

For eligible patients, financing transforms “later” into “scheduled.”

Instant receipts, written confirmation, and accessible records reduce anxiety and staff follow-up.

Manual back-and-forth creates delays and inconsistency. Automation reduces error while preserving human oversight.

Are heva leaders in reducing payment friction in cross-border care?

heva is an AI-native practice management and infrastructure platform designed for cross-border care—not a clinic, marketplace, or payment processor.

Within payment workflows, heva supports:

- secure digital payment initiation

- documented confirmations and receipts

- integration with scheduling and patient records

- optional BNPL financing access for eligible U.S. patients

- reduced manual coordination by staff

Because payment is embedded within a broader coordination system, it becomes part of a continuous care pathway, not a standalone transaction.

More importantly, heva supports end-to-end continuity—from first message to post-procedure follow-up—so payment friction does not reappear later in the journey. Learn more at heva for providers.

Why reducing friction matters more than acquiring more leads

Providers often focus on marketing volume, but system inefficiency quietly erodes results.

Health-system efficiency research from the OECD consistently shows that improving conversion within existing demand is more cost-effective than increasing top-of-funnel acquisition (see OECD health system performance analysis).

In cross-border care, every unanswered message, unclear invoice, or delayed confirmation widens the leak.

Reducing friction:

- increases completed care

- improves patient trust

- lowers staff burden

- strengthens clinical timelines

Contextual CTA

If your practice already receives international inquiries but loses momentum before booking or payment, it may be time to evaluate how payment friction fits into your care workflow.

Explore how coordinated, secure payment infrastructure supports cross-border care at https://www.heva.co/providers

Frequently Asked Questions

Why do international patients hesitate at the payment stage?

Because cross-border payments introduce uncertainty around security, confirmation, and recourse. Reducing ambiguity improves completion.

Is cash still common in international healthcare?

Yes, but regulators and central banks increasingly encourage digital alternatives due to transparency and safety concerns.

Does financing increase patient commitment?

Evidence from U.S. healthcare markets shows that installment access reduces delays and increases treatment follow-through when responsibly applied.

Is payment infrastructure part of patient safety?

Yes. Fragmented payment processes are associated with rushed scheduling and poor coordination, which can affect outcomes.

Does heva provide medical care?

No. heva is a coordination and infrastructure platform that supports providers in delivering seamless cross-border care.

Disclaimers

Medical Disclaimer: This article provides educational information about medical tourism and pricing. It is not medical advice. heva is a healthcare coordination platform connecting patients with providers—we do not provide medical advice, diagnosis, or treatment. All medical decisions should be made in consultation with qualified healthcare professionals in all relevant jurisdictions.

Safety Information: Safety recommendations are based on general best practices, public-health advisories, and published research. Individual risks and needs vary. Patients should conduct their own research, verify provider credentials, review travel advisories such as those from the U.S. State Department, and discuss plans with clinicians who understand bariatric surgery and medical tourism.

Financial Disclaimer: Information about costs, financing products, and savings is general and approximate. It does not constitute financial advice. Eligibility, interest rates, and terms are determined by external lenders and individual financial circumstances. Patients should review all loan agreements carefully and consider consulting an independent financial adviser before committing to significant medical debt.

International Healthcare: International medical care involves inherent risks and additional considerations including emergency protocols, legal differences, and care coordination. Patients should thoroughly research all aspects of cross-border surgery, maintain realistic expectations about potential complications and recovery, and ensure plans for long-term follow-up in their home country.