This Is How Doctors in the Dominican Republic are Providing Financing to International Patients

Quick Answer

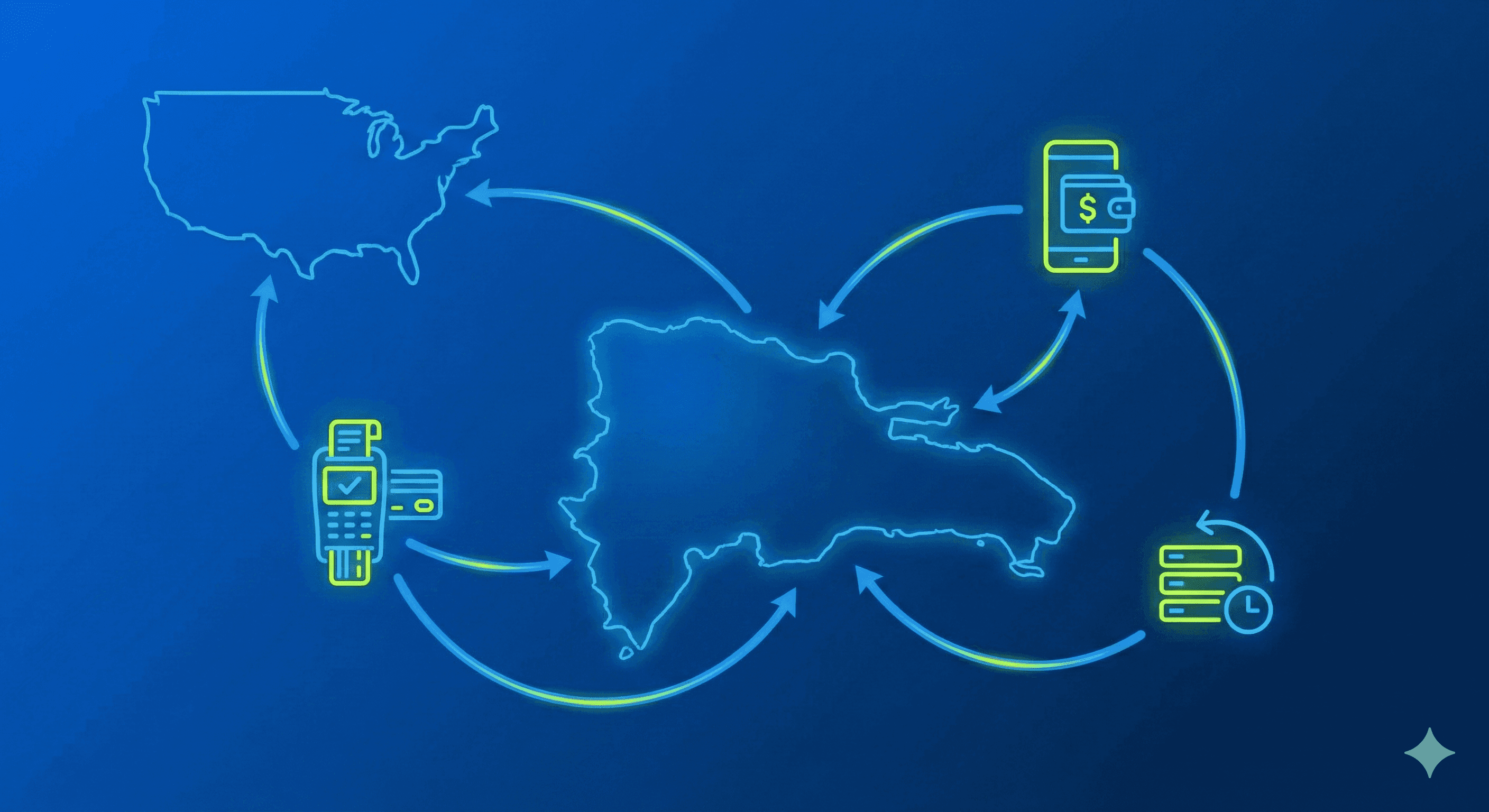

Many doctors in the Dominican Republic now rely on U.S. based platforms like heva to accept international payments and offer installment-based financing to eligible American patients. Testimonies mention removing cash barriers, reducing administrative friction, and allowing patients to pay securely from their phone in minutes.

What is medical tourism, and why does the Dominican Republic attract international patients?

Medical tourism refers to patients traveling outside their home country to receive medical care. According to the World Health Organization, the most common drivers are cost, access, wait times, and availability of specialized expertise .

The Dominican Republic has become a leading destination in the Caribbean for medical tourism due to:

- proximity to the United States

- U.S.-trained and internationally certified physicians

- private hospitals and specialty clinics

- significantly lower procedural costs

Based on analyses from Patients Beyond Borders and the Medical Tourism Association, the most common specialties drawing international patients to the DR include:

- plastic and reconstructive surgery

- bariatric surgery

- dentistry and implants

- orthopedics and spine care

- oncology and complex diagnostics

As patient volumes grew, so did the need for modern systems to handle communication, scheduling, and—critically—payments.

This is where platforms like heva began to change the landscape.

What is heva, and why are Dominican doctors adopting it?

heva is an AI-native, U.S.-based healthcare coordination platform designed specifically for cross-border care.

Headquartered in New York and backed by American institutional investors, heva provides infrastructure—not medical services—that helps clinics manage international patients end to end.

At a high level, heva allows doctors to:

- communicate with patients 24/7 in their language

- automate inbound inquiries using a personalized AI assistant

- manage scheduling and bookings instantly

- centralize patient records and documentation

- accept secure digital payments from abroad

- offer financing options to eligible U.S. patients

Importantly, heva is not a clinic, not a provider, and not a lender.

It acts as a facilitator, removing operational friction so doctors can focus on care.

Why have payments historically been a problem in Dominican medical tourism?

The Dominican Republic remains a cash-dominant economy.

According to the Central Bank of the Dominican Republic, cash and local bank transfers still represent a large share of private-sector transactions, including healthcare .

For international patients, this creates real challenges:

- carrying large amounts of cash

- navigating local bank transfers

- lack of digital receipts

- uncertainty around refunds or disputes

The World Bank and the Pan American Health Organization (PAHO) both identify payment friction as a major barrier to cross-border healthcare access .

How does heva enable cross-border payments for doctors?

heva modernizes payment acceptance while respecting local practice workflows.

Through heva, doctors can accept:

- international credit and debit cards

- mobile wallet payments

- U.S.-based bank transfers (ACH)

- cryptocurrency payments

- U.S. dollar–denominated stable digital assets (e.g., USD-pegged)

All transactions are:

- encrypted

- documented

- traceable

- accessible to patients from their own device

This directly addresses safety concerns outlined by the CDC in its medical tourism guidance .

How does financing work for U.S. patients without clinics becoming lenders?

This is the most misunderstood part of medical tourism financing.

Doctors in the DR do not lend money to patients.

Instead, through heva’s integrated payment infrastructure, eligible U.S. patients can access familiar installment-based healthcare financing models—widely used in the U.S. healthcare system—without the clinic handling credit risk.

Research published in BMJ Global Health shows that installment-based payment options significantly improve access to elective and quality-of-life care when implemented transparently .

Key points:

- approvals typically take minutes

- eligibility depends on external financial partners

- terms are disclosed upfront

- clinics receive payment without managing debt

This allows doctors to offer financing without financial exposure.

Why does financing improve safety, not just affordability?

Financing is often framed as convenience. In reality, it improves decision quality.

According to The Lancet Global Health, patients who understand costs upfront and avoid informal payments experience fewer disputes and better continuity of care .

By combining:

- written treatment plans

- itemized costs

- secure payments

- structured timelines

heva helps reduce the risk factors most commonly associated with poor medical tourism experiences.

How does heva improve the full patient journey beyond payments?

Payments are only one piece.

Every doctor on heva has a personalized AI assistant—their own heva—trained to reflect:

- their tone

- their policies

- their scheduling rules

- their intake process

No two hevas are identical.

This allows:

- immediate responses to patient inquiries

- automated booking of consultations or procedures

- instant calendar updates

- follow-ups without manual effort

The OECD identifies administrative burden as one of the largest inefficiencies in healthcare systems globally . heva directly addresses this for cross-border practices.

Why are doctors who care about patient experience choosing heva?

Doctors join heva not to replace human care—but to protect it.

By reducing:

- repetitive messaging

- payment confusion

- scheduling delays

- administrative overload

clinics can spend more time on clinical excellence and patient trust. This aligns with global digital health best practices outlined by the World Health Organization .

What this means for the future of medical tourism in the DR

Medical tourism in the Dominican Republic is no longer just about lower prices.

It’s about:

- structured access

- financial transparency

- safe coordination

- humane digital experiences

Platforms like heva make this possible—without becoming providers, without dictating care, and without compromising ethics.

Interested in joining heva as a provider?

Discover how doctors are modernizing international care at heva.co/providers

Frequently Asked Questions

Do all Dominican clinics offer financing?

No. Most still rely on cash or local transfers. Structured financing is typically available only through platforms that integrate payments and eligibility workflows.

Does heva provide loans or medical care?

No. heva is a coordination platform. Medical decisions remain with licensed providers, and financing decisions are made by external partners.

Can non-U.S. patients access financing?

At this time, installment-based financing is primarily available to eligible U.S. patients.

Is digital payment safer than cash?

According to the WHO and the CDC, documented digital payments reduce fraud risk and improve accountability compared to cash handling.

Disclaimers

Medical Disclaimer: This article provides educational information about medical tourism and pricing. It is not medical advice. heva is a healthcare coordination platform connecting patients with providers—we do not provide medical advice, diagnosis, or treatment. All medical decisions should be made in consultation with qualified healthcare professionals in all relevant jurisdictions.

Safety Information: Safety recommendations are based on general best practices, public-health advisories, and published research. Individual risks and needs vary. Patients should conduct their own research, verify provider credentials, review travel advisories such as those from the U.S. State Department, and discuss plans with clinicians who understand bariatric surgery and medical tourism.

Financial Disclaimer: Information about costs, financing products, and savings is general and approximate. It does not constitute financial advice. Eligibility, interest rates, and terms are determined by external lenders and individual financial circumstances. Patients should review all loan agreements carefully and consider consulting an independent financial adviser before committing to significant medical debt.

International Healthcare: International medical care involves inherent risks and additional considerations including emergency protocols, legal differences, and care coordination. Patients should thoroughly research all aspects of cross-border surgery, maintain realistic expectations about potential complications and recovery, and ensure plans for long-term follow-up in their home country.